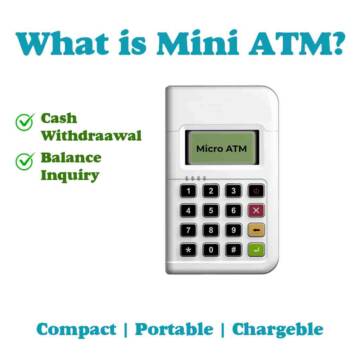

What is a Mini ATM? Exploring the Convenience of Micro ATMs

In an era defined by technological advancements, the way we access and manage our finances has undergone a significant transformation. One of the innovations that have greatly influenced the banking and financial services sector is the Mini ATM, also known as a Micro ATM. These pint-sized banking terminals have brought convenience and financial access to remote and underserved areas, empowering individuals with limited access to traditional banking services. In this comprehensive guide, we will delve into what Mini ATMs are, how they work, their benefits, and their impact on financial inclusion.

1) Unpacking the Mini ATM

1.1 Understanding the Basics

At its core, a Mini ATM is a compact electronic device designed to perform a range of banking transactions, often in areas where conventional bank branches are scarce or inaccessible. These diminutive machines enable individuals to carry out essential financial operations without the need for a brick-and-mortar bank presence. They are typically deployed in rural and semi-urban regions, empowering individuals who may not have access to traditional banking services.

1.2 How Does a Mini ATM Work?

A Mini ATM operates on a technology-driven model, offering basic banking services through a simplified user interface. Here’s how it generally works:

1.2.1 Authentication

To initiate a transaction, users must verify their identity. This can be done through various methods, including:

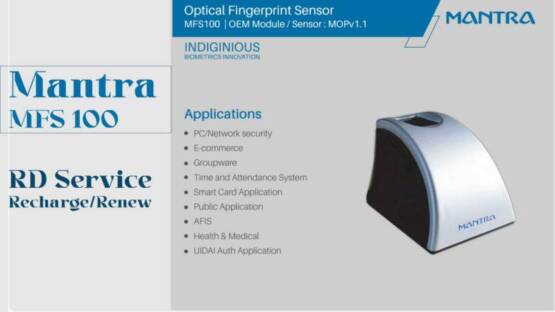

- Aadhar Authentication: Many Mini ATMs leverage the Aadhar system in India, using biometric data like fingerprints for secure identity verification.

- Smart Cards: Some devices employ smart cards with embedded chips that store user information.

- Mobile Numbers: In certain cases, users can authenticate transactions using their registered mobile numbers.

1.2.2 Transaction Selection

Once authenticated, users can select the type of transaction they wish to perform. Common transactions include:

- Cash Withdrawals: Users can withdraw money from their bank accounts, similar to a traditional ATM.

- Cash Deposits: Some Mini ATMs allow users to deposit cash into their accounts.

- Balance Inquiries: Users can check their account balances to keep track of their finances.

- Fund Transfers: These devices often facilitate fund transfers between accounts, making it easier for users to send money to family members or friends.

1.2.3 Transaction Processing

After selecting a transaction, users input the necessary details, such as the amount to withdraw or the recipient’s account information. The Mini ATM processes the transaction and provides a confirmation receipt.

1.2.4 Receipt and Confirmation

Users receive a printed or digital receipt as proof of the completed transaction. This confirmation helps maintain transparency and trust in the banking process.

2) The Advantages of Mini ATMs

2.1 Financial Inclusion

One of the primary advantages of Mini ATMs is their ability to promote financial inclusion. These machines bridge the gap between urban and rural areas, ensuring that even remote communities have access to essential banking services. Individuals who previously had to travel long distances to reach a bank branch can now perform transactions locally, saving both time and money.

2.2 Reduced Cash Dependency

Mini ATMs encourage the use of digital transactions, reducing the reliance on physical cash. This not only contributes to a safer and more transparent financial ecosystem but also aligns with government initiatives to promote a cashless economy.

2.3 Cost-Efficient Banking

Setting up and maintaining traditional bank branches in remote areas can be prohibitively expensive. Mini ATMs offer a cost-effective alternative, allowing banks to extend their services without the high overhead costs associated with physical branches.

2.4 Convenience and Accessibility

Mini ATMs are designed to be user-friendly, requiring minimal technical expertise to operate. Their small size and portability make them accessible to individuals of all backgrounds and ages, further democratizing financial services.

2.5 Real-Time Transactions

Transactions conducted through Mini ATMs are typically processed in real-time, ensuring that users have immediate access to their funds. This feature is particularly beneficial for those who rely on these services for daily financial needs.

2.6 Enhanced Security

Security is a top priority in the world of finance, and Mini ATMs take this seriously. Many devices employ biometric authentication, such as fingerprint recognition, to ensure secure user verification. Additionally, all transactions are logged and traceable, reducing the risk of fraudulent activities.

3) Challenges and Concerns

While Mini ATMs bring numerous advantages, they also come with their share of challenges and concerns that need to be addressed:

3.1 Connectivity Issues

Many rural and remote areas lack reliable internet connectivity, which is essential for real-time transactions on Mini ATMs. Without a stable internet connection, users may face difficulties accessing banking services.

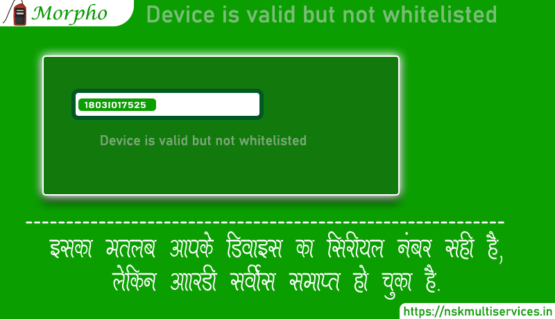

3.2 Biometric Accuracy

The accuracy of biometric authentication, such as fingerprint recognition, can be affected by factors like poor fingerprint quality, worn-out fingers, or adverse environmental conditions, leading to authentication failures.

3.3 Security Concerns

Although Mini ATMs offer secure transactions, there is still a risk of biometric data being compromised. Safeguarding biometric data and implementing robust encryption measures are essential to prevent unauthorized access.

3.4 Privacy Issues

Collecting and storing biometric data raise concerns about privacy and data protection. Appropriate safeguards must be in place to protect individuals’ sensitive information from potential breaches.

3.5 Training and Awareness

Users in rural areas may not be familiar with technology or may lack the necessary training to operate Mini ATMs effectively. This can lead to errors or misuse of the machines.

3.6 Maintenance and Infrastructure

Maintaining Mini ATMs in remote areas can be challenging due to limited access to technical support and infrastructure. Harsh environmental conditions can also lead to wear and tear, affecting the longevity of these devices.

3.7 Fraud and Security Threats

Mini ATMs, like any electronic payment system, are susceptible to fraud and security threats, including card cloning, skimming, and malware attacks. Ensuring robust security measures is crucial to protect users.

3.8 Interoperability

For maximum convenience, Mini ATMs from different banks and service providers should be interoperable. Lack of interoperability can limit customer access and convenience.

3.9 Financial Literacy

Many individuals in rural areas may not be financially literate, which can lead to misunderstandings or misuse of Mini ATM services. Financial education is essential to ensure responsible use.

3.10 Regulatory and Compliance Challenges

Mini ATMs must adhere to various regulatory and compliance requirements. Ensuring that these requirements are met can be complex, especially for smaller service providers.

3.11 Dependency on Aadhar

Over-reliance on Aadhar for authentication can be problematic if individuals face issues with their Aadhar data or if Aadhar-based authentication is unavailable.

4) Future Outlook

Despite the challenges and concerns, Mini ATMs hold immense promise for the future of banking and financial services, especially in regions where access has traditionally been limited. Here are some potential developments on the horizon:

4.1 Improved Technology

Advancements in biometric technology and connectivity solutions are expected to address many of the current challenges faced by Mini ATMs. More accurate authentication methods and enhanced security protocols will likely become standard features.

4.2 Enhanced Connectivity

Government and private sector initiatives to expand internet connectivity in rural areas will play a crucial role in ensuring that Mini ATMs can function effectively across the country.

4.3 Financial Literacy Programs

Financial institutions and governments can invest in financial literacy programs to educate users in rural areas about responsible banking practices, ensuring that Mini ATMs are used effectively.

4.4 Diverse Services

Mini ATMs may evolve to offer additional services beyond basic banking, such as utility bill payments, insurance purchases, and access to government benefits, further enhancing their utility.

4.5 Regulatory Frameworks

Governments and regulatory bodies will continue to refine and update the regulatory frameworks surrounding Mini ATMs to ensure security, privacy, and compliance with emerging technologies.

Related Articles

5) Mini ATM Service Providers

Mini ATMs are often operated by banking correspondents (BC) or agents, who are authorized by banks or third arty company to offer basic banking services to customers. These agents may include local shopkeepers, post offices, and other entrepreneurs. The mini ATM enables these agents to offer banking services to customers without the need for a physical bank branch.

Relipay Mini ATM

We are working as super distributor of RNFI services and provide banking service all over India. If you are interested in buying the Mini ATM device, you can click on the link given below to know the offer details.

Conclusion

In conclusion, Mini ATMs represent a remarkable advancement in the world of banking and finance, opening doors to financial inclusion for millions of people in remote and underserved areas. These small yet powerful devices bring essential banking services to the fingertips of individuals who were previously excluded from the formal financial system. While challenges exist, ongoing technological innovations and concerted efforts from governments, financial institutions, and technology providers are poised to overcome these obstacles.

As Mini ATMs continue to evolve and become more accessible and secure, they hold the potential to transform not only how we access financial services but also how we envision a more inclusive and interconnected financial landscape.