Flat Rs. 1 Commission on Mini Statement

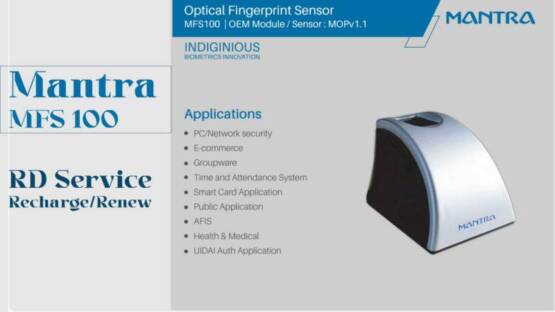

In the AePS market RNFI Services is the first company which started the Mini Statement service with commission. After it Spice Money and Paynearby implemented the mini statement service in their portal/App. The mini statement service is available only with AEPS Service. Mini Statement service is not available with mATM or mPOS. However, retailers can do the balance inquiry and cash withdrawal transaction using debit card.

Unlimited Commission on Mini Statement

This commission is applicable to every mini statement transaction. If a retailer makes a mini statement transaction of single person for five times, then retailer will get total of five rupees commission in his wallet. Whereas, Some companies limit the Mini Statement commission to only two rupees. Every type of commission provided by RNFI is instantly settled in Retailers wallet.

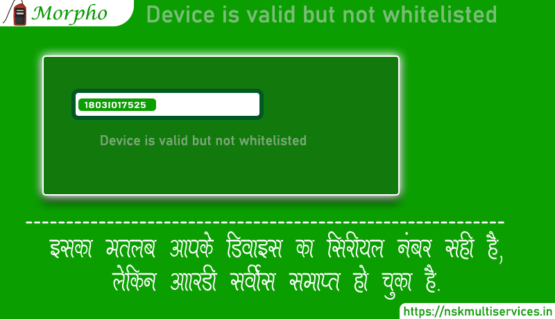

Note

- Maximum banks does not charge for the Mini Statement transaction.

- As we know, only Bank of India is charging 3.14 rupees to their customer for Mini Statement transaction. If you find that any other bank is also charging for Mini Statement, then Please inform us using comment in the below of this post.

- Only 5 attempts are allowed for AEPS transaction within 24 hours of a person. All failed and succeed transaction are counted in scenario.

- Using mini statement, customers can get most recent 9 transaction.