Enhancing Financial Inclusion: Micro ATM Machines with Fingerprint for Aadhar Authentication

In an era of digital transformation, ensuring universal access to banking services is a paramount objective. India, with its vast population, has been at the forefront of employing technology to extend financial services to even the most remote regions. A cornerstone of this endeavor has been the “Micro ATM Machine with Fingerprint for Aadhar Authentication.” This guide provides a comprehensive exploration of this technology, its significance, operational mechanics, and its profound impact on financial inclusion in India.

1) Understanding Aadhar Authentication

What is Aadhar?

Aadhar, a unique 12-digit identification number issued by the Government of India, is a foundational element of this discussion. It serves as a linchpin in various aspects of life, particularly in the financial realm.

Aadhar Authentication Explained

Aadhar authentication is the process of verifying the identity of an individual by cross-referencing their Aadhar number with the biometric or demographic information stored in the Aadhar database. This procedure holds pivotal importance in multiple sectors, with financial services being a primary beneficiary.

2) The Emergence of Micro ATM Machines

The Need for Financial Inclusion

For India’s rural and underserved populations, accessing formal banking services has historically been a challenge. This section uncovers the barriers that necessitated innovations like Micro ATM machines.

Introduction to Micro ATM Machines

Micro ATM machines, an ingenious solution to the financial inclusion dilemma, are compact, portable devices that serve as a conduit to banking services. They transcend geographical barriers, ensuring access to financial transactions for all.

3) The Role of Fingerprint Recognition

Fingerprint Biometrics

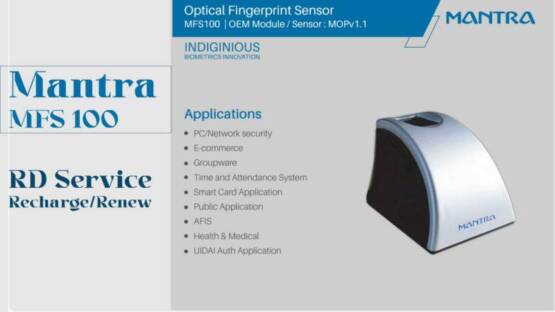

At the heart of Micro ATM machines lies the technology of fingerprint recognition. Known for its precision and reliability, fingerprint biometrics forms the bedrock of secure authentication.

Fingerprint Authentication in Micro ATMs

Micro ATM machines utilize fingerprint recognition technology to authenticate users. By matching the scanned fingerprint with the database records, access to banking services is granted securely.

4) How Micro ATM Machines with Fingerprint for Aadhar Authentication Work

Hardware and Software Components

A Micro ATM machine comprises intricate hardware and software components, synergizing seamlessly to deliver a user-friendly experience.

The Authentication Process

This section provides a step-by-step walkthrough, illustrating how a Micro ATM, integrated with fingerprint authentication for Aadhar, operates. From initiating the transaction to receiving a confirmation, every stage is elucidated.

5) The Impact on Financial Inclusion

Bringing Banking to the Unbanked

Micro ATM machines, with Aadhar authentication, have been a transformative force in extending banking services to regions that were once beyond the reach of traditional banking infrastructure. This segment showcases the tangible differences this technology has made.

Reduction in Financial Frauds

The integration of fingerprint authentication has fortified security in financial transactions, significantly reducing the incidence of fraud and unauthorized access.

6) Benefits and Challenges

Benefits of Micro ATM Machines with Fingerprint for Aadhar Authentication

- Extends banking to unbanked and underbanked populations, promoting financial inclusion.

- Aadhar authentication ensures highly secure identity verification, reducing the risk of fraud.

- Convenience and Accessibility

- Enables various transactions without visiting a physical branch, crucial for remote areas.

- Reduces cash handling risks, promotes digital transactions, and cuts operational costs for banks.

- Empowering Rural Economies

- Access to banking services empowers rural communities, fostering savings, credit access, and economic growth.

- Enhanced Security and Efficiency

- Real-time transactions and traceable, secure authentication further enhance the system’s integrity.

- Government initiatives in India actively support Aadhar-based micro ATMs, making them an accessible and user-friendly solution.

Challenges and Concerns

While Micro ATM machines have indeed ushered in a new era of accessibility, it’s imperative to acknowledge that, like any transformative technology, they come with their set of challenges and considerations.

- Connectivity Issues: Rural and remote areas often have unreliable or limited internet connectivity. Micro ATMs require a stable internet connection for real-time transactions, which can be a significant challenge in such regions.

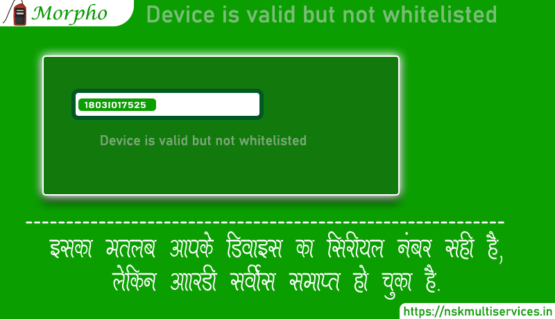

- Biometric Accuracy: The accuracy of biometric authentication, such as fingerprint recognition, can be affected by factors like poor fingerprint quality due to manual labor, worn-out fingers, or environmental conditions, which can lead to authentication failures.

- Security Concerns: While fingerprint authentication is generally secure, there is still a risk of biometric data being compromised. Protecting the stored biometric data and ensuring robust encryption are essential to prevent unauthorized access.

- Privacy Issues: Collecting and storing biometric data raises concerns about privacy and data protection. Adequate safeguards must be in place to protect individuals’ sensitive information.

- Training and Awareness: Users in rural areas may not be familiar with technology or may lack the necessary training to operate micro ATMs. This can lead to errors or misuse.

- Maintenance and Infrastructure: Maintaining micro ATM machines in remote areas can be challenging due to limited access to technical support and infrastructure. Harsh environmental conditions can also lead to wear and tear.

- Fraud and Security Threats: Like any electronic payment system, micro ATMs are susceptible to fraud and security threats, including card cloning, skimming, and malware attacks. Ensuring robust security measures is crucial.

- Interoperability: Micro ATMs from different banks and service providers should ideally be interoperable to ensure that customers can use any micro ATM for transactions. Lack of interoperability can limit customer access and convenience.

- Financial Literacy: Many individuals in rural areas may not be financially literate, which can lead to misunderstandings or misuse of micro ATM services. Financial education is essential to ensure responsible use.

- Regulatory and Compliance Challenges: Micro ATMs must adhere to various regulatory and compliance requirements. Ensuring that these requirements are met can be complex, especially for smaller service providers.

- Accessibility and Inclusivity: Micro ATM machines should be accessible to individuals with disabilities and cater to diverse user needs to ensure inclusivity.

- Cost of Implementation: While micro ATMs are cost-effective compared to traditional branches, the initial investment in setting up the infrastructure and providing training can be substantial.

- Dependency on Aadhar: Over-reliance on Aadhar for authentication can be problematic if individuals face issues with their Aadhar data or if Aadhar-based authentication is unavailable.

Addressing these challenges and concerns requires a coordinated effort from government agencies, financial institutions, and technology providers. It involves investing in infrastructure, enhancing cybersecurity measures, ensuring privacy and data protection, providing training and education, and regularly assessing and improving the system’s performance and security.

Related Articles

Conclusion

- Micro ATM Machines with Fingerprint for Aadhar Authentication drive financial inclusion in India.

- Aadhar authentication is crucial in verifying identity, especially in finance.

- Micro ATMs address the challenge of providing formal banking to rural populations.

- Fingerprint recognition is key to secure authentication in Micro ATMs.

- They streamline transactions, reducing the need for physical visits, especially in remote areas.

- Fingerprint authentication enhances security, curbing fraud in transactions.

- Micro ATMs promote digital transactions, lowering cash-handling risks.

- They’re a cost-effective solution for extending services, especially in rural areas.

- Access to Micro ATMs empowers rural communities, fostering savings, credit access, and growth.

- Despite benefits, challenges include connectivity, biometric accuracy, and privacy concerns.

- Adequate training and awareness are crucial for effective Micro ATM use, especially in rural areas.

- Maintaining Micro ATMs in remote regions can be challenging due to limited support and harsh conditions.

- Ensuring robust security is essential, as Micro ATMs are susceptible to fraud and threats.

- Interoperability among Micro ATMs is vital for seamless customer access.

- Financial literacy programs are crucial for responsible Micro ATM use, especially in areas with limited tech exposure.

- Compliance with regulatory requirements is vital for Micro ATMs, especially for smaller providers.

- Prioritizing accessibility and inclusivity in Micro ATM design and deployment is essential.

- While cost-effective long-term, initial setup involves a substantial investment in infrastructure and training.

- Over-reliance on Aadhar for authentication can be problematic if individuals face challenges with their Aadhar data.