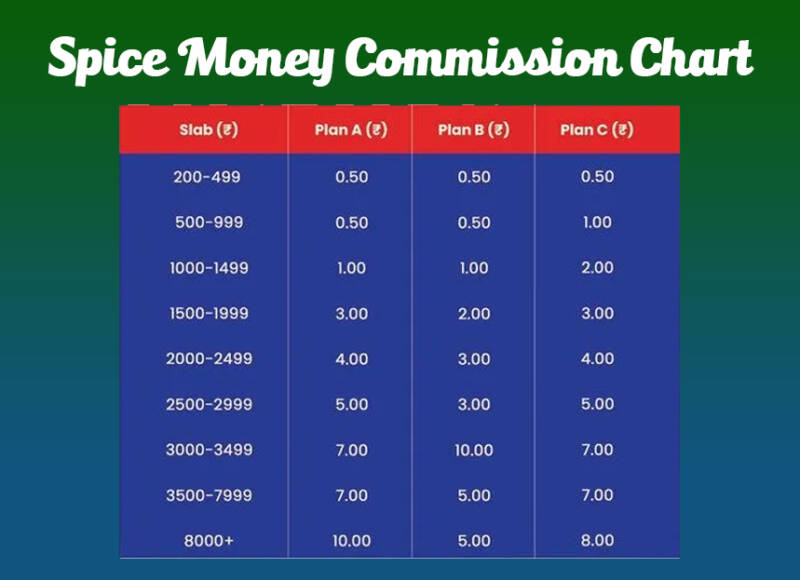

Understanding Spice Money Commission Structure

Spice Money Commission Chart: In the dynamic realm of financial services, understanding the intricacies of commission structures is paramount for individuals looking to maximize their earnings potential. This chapter delves into the nuances of the Spice Money commission structure, shedding light on its various elements and implications for retailers.

The Essence of Spice Money Commission Structure

Spice Money, a leading B2B service provider in India, offers a range of basic banking services to its retailers. At the heart of its operations lies a comprehensive commission structure, which serves as the backbone of its business model. Understanding this structure is essential for retailers aiming to leverage Spice Money’s offerings effectively.

Commission Plans Overview

Spice Money provides three distinct commission plans for retailers to choose from, each catering to different business needs and preferences. These plans, labeled as Plan A, Plan B, and Plan C, offer varying commission rates based on transaction amounts and frequency.

1. Spice Money AePS Commission

Spice Money’s AePS commission structure is a critical component of its business model, offering retailers a lucrative opportunity to earn commissions by facilitating Aadhar-enabled payments. Understanding the key aspects of this commission structure is essential for retailers aiming to maximize their earnings and provide seamless financial services to customers.

Commission Plan Variants

Spice Money offers retailers three distinct AePS commission plans, each tailored to cater to different business needs and transaction volumes. These plans, categorized as Plan A, Plan B, and Plan C, vary in commission rates and eligibility criteria, allowing retailers to choose the plan that best aligns with their operational requirements and revenue goals.

| Amount Slab (Rs.) | Plan A (Rs.) | Plan B (Rs.) | Plan C (Rs.) |

|---|---|---|---|

| 1 – 199 | NIL | NIL | NIL |

| 200 – 299 | 0.50 | 0.50 | NIL |

| 300 – 499 | 0.50 | 0.50 | 0.18% |

| 500 – 999 | 1.1 | 0.50 | 0.18% |

| 1000 – 1499 | 2.25 | 1 | 0.18% |

| 1500 – 1999 | 3.25 | 2 | 0.18% |

| 2000 – 2499 | 5.25 | 3 | 0.18% |

| 2500 – 2999 | 6 | 3 | 0.18% |

| 3000 – 3499 | 8.25 | 10 | 0.18% |

| 3500 – 4999 | 8.25 | 5 | 0.18% |

| 5000 & above | 9 | 5 | 0.18% |

Spice Money Mini ATM Commission

Spice Money’s Mini ATM commission structure offers retailers a lucrative opportunity to earn commissions by providing convenient cash withdrawal services to customers. Understanding the intricacies of this commission structure is crucial for retailers seeking to maximize their earnings and enhance customer satisfaction.

| Amount Slab (Rs.) | Plan A (Rs.) | Plan B (Rs.) | Plan C (Rs.) |

|---|---|---|---|

| 1 – 199 | NIL | NIL | NIL |

| 200 – 299 | 0.50 | 0.50 | NIL |

| 300 – 499 | 0.50 | 0.50 | 0.18% |

| 500 – 999 | 1.1 | 0.50 | 0.18% |

| 1000 – 1499 | 2.25 | 1 | 0.18% |

| 1500 – 1999 | 3.25 | 2 | 0.18% |

| 2000 – 2499 | 5.25 | 3 | 0.18% |

| 2500 – 2999 | 6 | 3 | 0.18% |

| 3000 – 3499 | 8.25 | 10 | 0.18% |

| 3500 – 4999 | 8.25 | 5 | 0.18% |

| 5000 & above | 9 | 5 | 0.18% |

Flexibility and Adaptability

One of the key advantages of the Spice Money commission structure is its flexibility. Retailers have the freedom to switch between commission plans based on their evolving requirements and business strategies. This adaptability ensures that retailers can optimize their earnings in alignment with market dynamics and customer demands.

Importance of Familiarity with Commission Rates

An in-depth understanding of Spice Money’s commission rates empowers retailers to make informed decisions and capitalize on lucrative opportunities. By staying abreast of the latest commission updates and trends, retailers can position themselves for success in the competitive financial services landscape.

Related Articles

Maximizing Profitability

By leveraging knowledge of commission rates, retailers can identify high-yield transaction categories and prioritize activities that yield maximum returns. This strategic approach enables retailers to maximize their profitability and drive sustainable business growth over time.

Enhancing Customer Service

Furthermore, familiarity with commission rates allows retailers to offer transparent and competitive pricing to customers. By providing clarity on transaction costs and potential earnings, retailers can enhance customer satisfaction and loyalty, fostering long-term relationships and repeat business.

Conclusion

In conclusion, understanding the Spice Money commission structure is fundamental for retailers seeking to thrive in the financial services sector. By grasping the nuances of commission plans and rates, retailers can unlock new opportunities for growth, profitability, and customer satisfaction. Stay tuned for further insights into Spice Money’s offerings and strategies for success in subsequent chapters.