What is mPOS Machine?

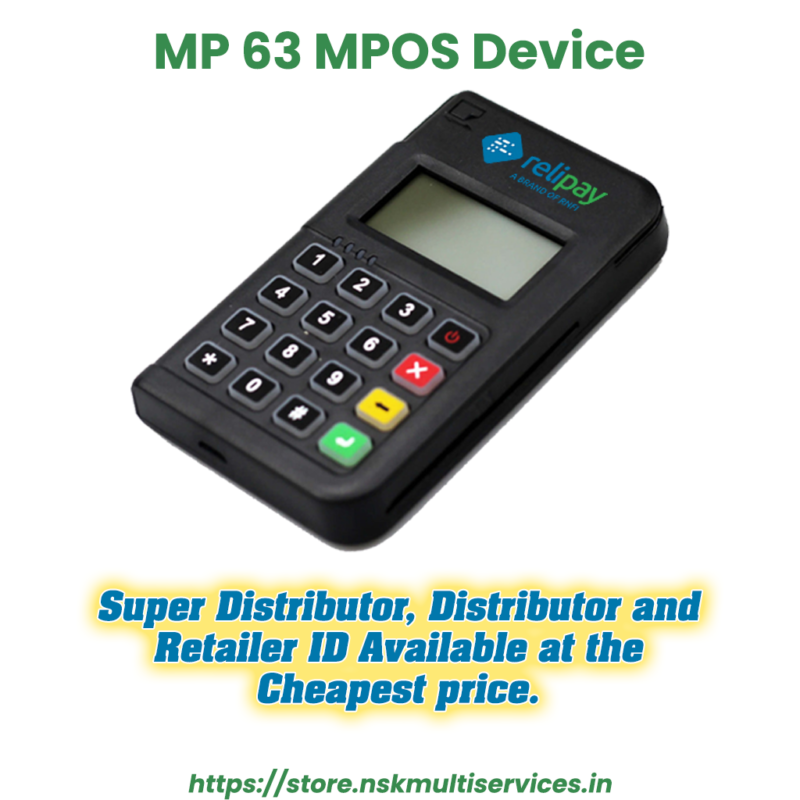

mPOS Machine : mPOS (mobile point of sale) machine refers to a mobile device that enables merchants to accept card payments, such as credit cards and debit cards, directly from customers. An mPOS machine is typically a small, portable device that connects to a smartphone or tablet via Bluetooth and allows merchants to swipe, dip, or tap a card to complete a transaction.

An mPOS machine is a cost-effective alternative to traditional point of sale (POS) systems and can be used by small businesses, merchants, and retailers who do not have a physical storefront or want to process payments on-the-go.

Also read : RNFI Services – ME30S mPOS Device

How does an mPOS work?

Any smartphone or tablet can be transformed into an mPOS with a downloadable mobile app. Typically, when a you registers with an app, the vendor sends you a card reader that plugs into the mobile device’s audio jack to process debit/credit cards. Some mPOS software vendors also provide optional hand-held docking stations called sleds that enable the mobile device to read barcodes and print receipts.

Depending on the software, an mPOS can operate as a stand-alone device that’s simply linked to the business’s bank account or it can be integrated as part of a larger, legacy POS system. To protect cardholder data, customer data is encrypted and stored in the cloud — not on the device.

Also Read : POS Machine Cost in India

Benefits of mPOS

Some of the benefits of using an mPOS machine include:

- Increased mobility: An mPOS machine allows merchants to accept payments anywhere, at any time, as long as they have a mobile device and an internet connection.

- Reduced costs: An mPOS machine eliminates the need for expensive POS hardware, which can save merchants money on upfront costs and ongoing maintenance fees.

- Easy setup: Most mPOS machines are easy to set up and use, and can be activated within minutes.

- Secure transactions: An mPOS machine uses encryption and other security measures to protect sensitive card information and ensure secure transactions.

- Improved customer experience: An mPOS machine allows merchants to accept card payments quickly and easily, which can improve the overall customer experience and increase customer satisfaction.

Top vendors

There are numerous mPOS offerings available to businesses. Popular mobile POS vendors include Banking Institutions, Rapipay, Roinet, Oxigen.

Square is considered one of the best and most prominent free mPOS offerings for small businesses. Square is an all-in-one offering, meaning it combines a credit card processing service and a full suite of business management tools in one app.

Choosing the right mPOS vendor can be difficult. We have put together a list of questions business leaders should ask themselves when deciding which mPOS offering to go with.

- How much can I afford to pay for software and hardware?

- Would I prefer an app that has a built-in processor or would I like to choose my own?

- What features must I absolutely have?

- What features would I like to have?

- Does this software integrate with any other software solutions I currently use?

- If not, am I willing to switch to one that does integrate with my solutions?

- Is my business model compatible with my preferred payment processor?