In today’s digital age, financial transactions are evolving rapidly, and the Aadhaar Enabled Payment System (AEPS) is at the forefront of this transformation. With AEPS, you can facilitate seamless banking services using just your Aadhaar number.

If you’re looking to become an AEPS agent and register online for free, you’ve come to the right place! This guide will walk you through the process, the benefits of AEPS, and how you can kickstart your journey in the financial services sector.

What is AEPS?

AEPS stands for Aadhaar Enabled Payment System, a payment service that allows users to make financial transactions using their Aadhaar number linked to their bank account.

This system was introduced by the National Payments Corporation of India (NPCI) to promote digital transactions and financial inclusion. With AEPS, users can perform various banking services, including:

- Cash withdrawals

- Balance inquiries

- Mini-statements

These services fall under the AePS category. AePS apps are not limited to just AePS services; they also offer additional services like Micro ATM, Money Transfer, Recharge, Bill Payment, and more.

Why Become an AEPS Agent?

Becoming an AEPS agent comes with numerous benefits:

- Low Investment (Approx. Rs. 0 ): You can start your AEPS business with minimal investment, making it accessible for many.

- High Demand: With the increasing push for digital payments, the demand for AEPS services is on the rise.

- Flexible Income: Agents earn a commission on each transaction, providing a flexible income stream.

- Empower Your Community: As an AEPS agent, you help people access banking services conveniently, especially in rural areas.

How to Register for AEPS Online for Free

Step 1: Choose a Reliable Service Provider

The first step in your AEPS journey is to select a trustworthy AEPS service provider. Some well-known providers include:

- Relipay (RNFI Services)

- Ezeepay

- Spice Money

- ThnxPe

Step 2: Gather Required Documents

Before you start the registration process, ensure you have the following documents ready:

- Aadhaar Card: Your unique identification number.

- PAN Card: For identity verification and tax purposes.

- Passport-sized Photograph: A recent photo for your application.

- Proof of Address: Utility bills, bank statements, or any government-issued documents.

Step 3: Fill Out the Online Registration Form

Visit the official website of your chosen service provider and locate the AEPS registration section. Fill out the online registration form with accurate information, including:

- Personal details (name, email, phone number)

- Aadhaar number

- Physical Shop Details

- Bank account details for settlement

If you want to register as Retailer or Distributor with RNFI Services, then contact us on WhatsApp – 9834754391

Step 4: Submit Your Application

Once you have completed the form, upload the required documents. Double-check everything to ensure accuracy, then submit your application.

Step 5: Verification Process

After submission, the service provider will review your application and documents. This verification process can take anywhere from a few hours to a couple of days. Once verified, you will receive your AEPS agent login credentials via email or SMS.

Step 6: Set Up Your AEPS Business

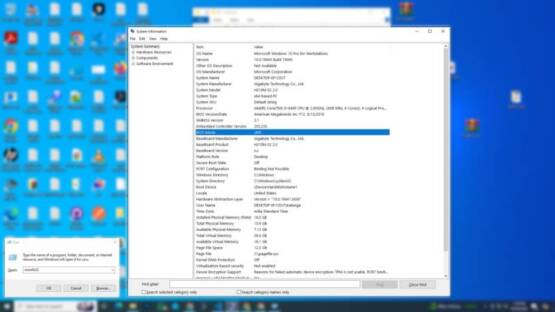

After receiving your credentials, you’ll need to set up your AEPS business:

- A Biometric Device: This device will allow you to authenticate transactions using fingerprints (Mantra MFS110, Morpho, Startek etc ).

- Download the AEPS App: Most service providers offer a dedicated app for agents to manage transactions easily.

Step 7: Start Offering Services

With everything set up, you can start providing AEPS services to customers. Promote your services in your community, and watch your business grow!

Conclusion

Registering for AEPS online for free is a straightforward process that opens up a world of opportunities in the financial sector. By becoming an AEPS agent, you not only enhance your income potential but also contribute to the financial empowerment of your community.

Follow this guide, and take the first step towards a rewarding venture in digital payments today! By following these steps, you can embark on an exciting journey as an AEPS agent.

Embrace the digital revolution and make a difference in your community while earning a sustainable income!

Frequently Asked Questions

What is AEPS and how does it work?

AEPS allows users to perform banking services like cash withdrawals, balance inquiries, and fund transfers using their Aadhaar number linked to their bank account. It works by authenticating transactions through biometric devices.

Who can become an AEPS agent?

Anyone with a valid Aadhaar card, PAN card, and bank account can become an AEPS agent. There are no specific educational or professional requirements.

How much investment is required to start an AEPS business?

The initial investment is minimal, mainly consisting of acquiring a biometric device and setting up a bank account. Most service providers offer free registration.

What are the benefits of becoming an AEPS agent?

Benefits include a flexible income stream, low investment, high demand, and the ability to empower your community by providing convenient banking services.

Which documents are required for AEPS registration?

You’ll need your Aadhaar card, PAN card, passport-sized photograph, and proof of address like utility bills or bank statements.

How long does the AEPS registration process take?

The registration process can take anywhere from a few hours to a couple of days, depending on the service provider and the verification of your documents.

How do I earn money as an AEPS agent?

AEPS agents earn a commission on each transaction performed by customers. The commission varies based on the service provider and the type of transaction.

Can I offer AEPS services in rural areas?

Absolutely! AEPS is particularly beneficial in rural areas where access to banking services may be limited. As an agent, you can provide these services conveniently to your community.